Michael W. Sonnenfeldt is the Founder and Chairman of TIGER 21.

TIGER 21, the premier peer membership organization for ultra-high-net-worth wealth creators and preservers, allows Members to learn from one another in their monthly meetings. The organization’s groups function as a personal board of directors for its constituent members, providing them with a unique and confidential forum in which to concentrate on improving their investment acumen and wealth preservation that focuses on leveraging collective wisdom, shining a light on personal blind spots. The more than 1,450 global Members collectively manage personal assets that exceed USD 165 billion.

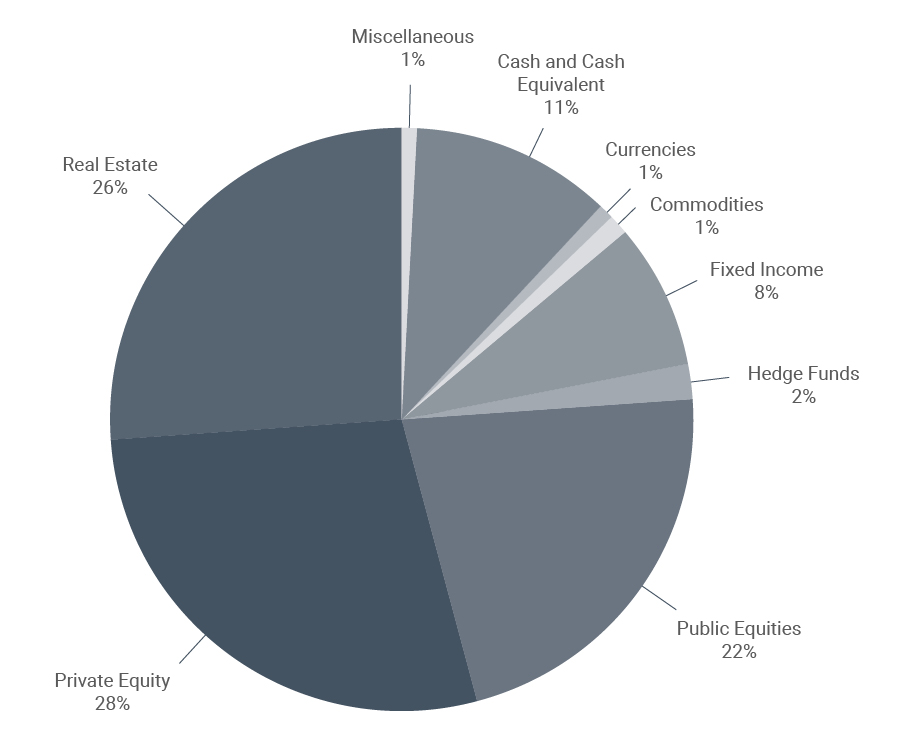

The TIGER 21 Asset Allocation Report measures aggregate asset allocations (on a trailing 12-month basis) of Members based on their individual annual portfolio defense presentations.

TIGER 21 Member Allocation (Q3 2023–Q2 2024)

TIGER 21 Members — entrepreneurs, investors, and top executives — many of whom recently sold their businesses, are generally concerned about preserving their wealth. In recent years, private equity has toppled real estate as their largest allocation. Real estate was king for the prior 15 years, in part because so many Members created their wealth in the real estate arena. The long bet is now on private assets, with public assets down to just 22% among Members, and with a growing concentration of indexes and exchange-traded funds, even within the shrinking public equity allocation.

In the world of the internet and digital technology, where building companies to global scale is more common than ever, our Members are able to create significant wealth at an earlier age. As such, TIGER 21 is attracting younger Members — many in their 30s and 40s — with the average age in the early 50s.

The current artificial intelligence (AI) revolution has provided an opportunity for investors in the public markets with the group of large American tech firms known as the Magnificent Seven, namely, Apple, Microsoft, Amazon, NVIDIA, Meta, Alphabet, and Tesla. TIGER 21 Members’ interest in public equities has grown by 3% in the last year, although a significant portion of this is simply a reflection of the rise in the public markets.

A recent survey showed that 43% of Members are investing in NVIDIA, with 57% expecting that the firm’s success will last for the next decade. In recent years, investing in the Magnificent Seven has offered a unique opportunity to invest in AI by buying shares in the top technology companies and. whether AI succeeded or failed, what was left of each company was still a world-class technology leader with almost endless possibilities. Previously, to play a new high-tech opportunity you had to invest in a small company that was so dependent on one innovation that there was little left of the investment if it failed.

To reflect on these trends, public equities offer some benefits such as liquidity, transparency, regulatory oversight, and lower fees, while superior returns were historically gained in the illiquid private equity markets. However, the outperformance of the Magnificent Seven has been extraordinary. Periods like this have occurred in the past, but now, the outperformance has largely been concentrated in these seven unique tech stocks. Simply put, they have driven the markets.

After occupying the number one spot for 15 years, real estate is now the second-largest allocation of Members’ portfolios at 26%, having been surpassed by private equity. Members see opportunities in last-mile real estate but there is less interest in the office and retail space. Because our Members can invest directly in distressed opportunities and often have created their wealth as developers, they are better able to leverage the opportunities available in the current dynamic real estate markets. Whereas a seller might be trying to offload an underutilized office building, nimble investors may see that as a future residential or hotel offering where the renovation costs can create an attractive financial opportunity, dynamic change creates winners and losers, and for those prepared the opportunities can be compelling.

TIGER 21 Members’ allocation to hedge funds dropped to 2% from 12% over the past 16 years.

Hedge funds are ‘dead’ — maintaining a steady position at 2% as many Members have limited their investment in this sector. Many investors think the risk-adjusted, after-fee returns are simply better in index funds.

Despite many mixed signals in the economy, our Members are heavily invested ‘long’ with 76% of their portfolio in real estate, public equity, and private equity. Over the last 15 years, the increase in private equity asset allocation has been dramatic but, anecdotally, Members believe venture capital offers the largest growth within the private equity sector. Starting businesses is how most TIGER 21 Members created their wealth, averaging about 1 in 10,000 by accomplishment, and they have honed skills that can give them a leg up when investing in new businesses. Members want to invest directly where they can in businesses with huge potential, and this is precisely where their unique backgrounds provide experience and insights that they believe give them an advantage. This is one of the best ways for entrepreneurs to become better investors after they sell a business.